Notes from Nansen Office Hours #39

NOTES from Nansen Office Hours #39

00:00:00 - Intro

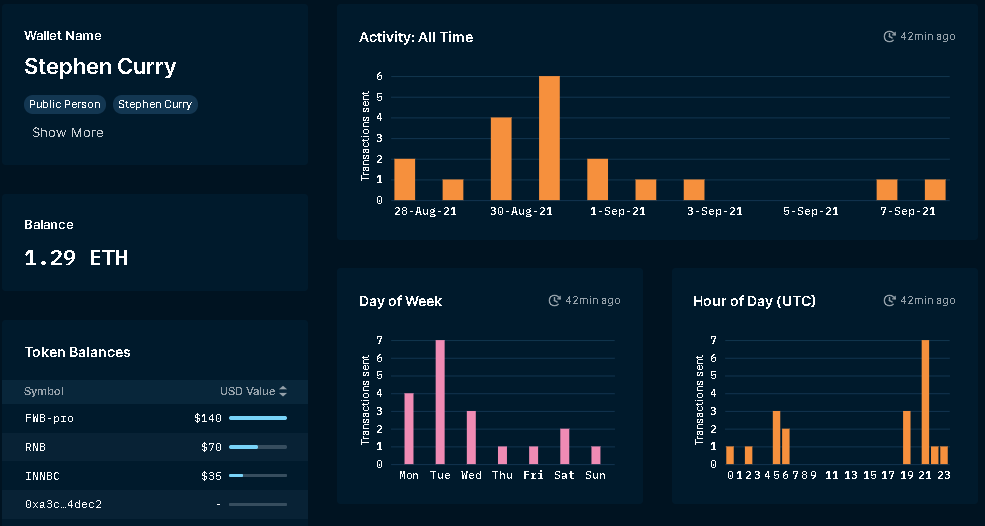

00:02:55 – Stephen Curry bought a Pudgy Penguin!

How to spot his transaction / wallet on-chain:

1) Breakdown – Balances & Changes

2) Scroll through most recent transactions

3) Look for “Stephen Curry (0x3bec)” label

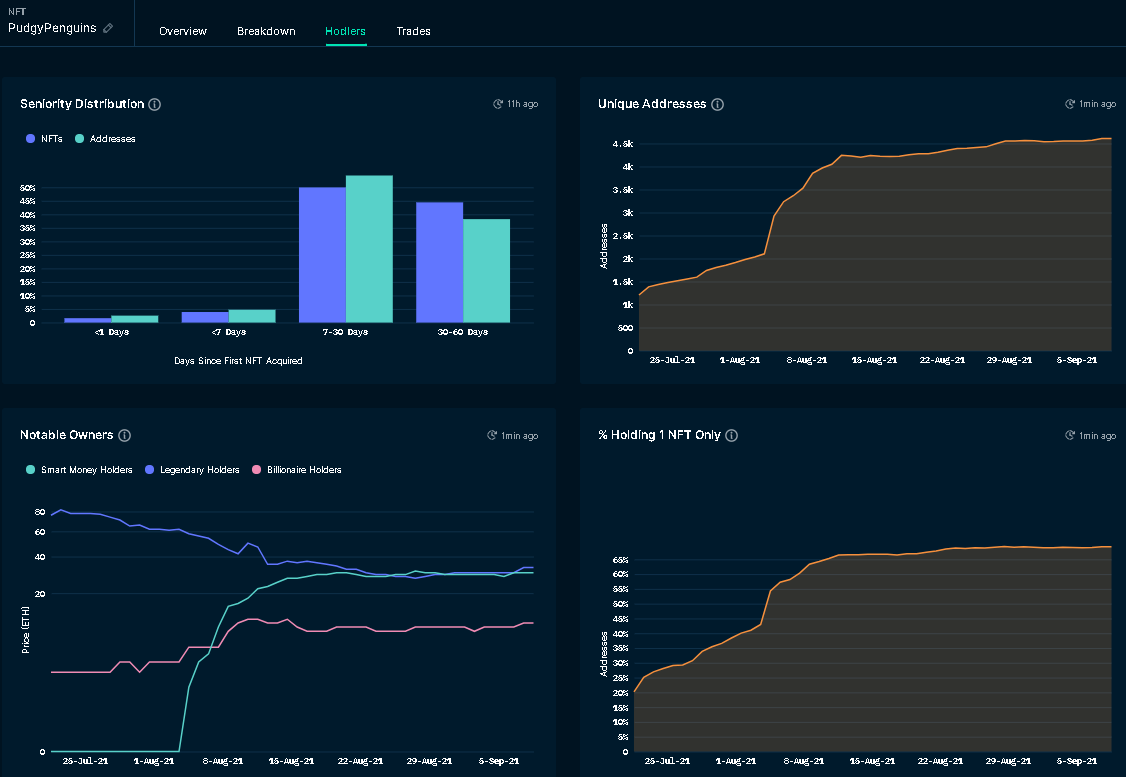

00:06:05 –Penguin distribution

70% of Pudgy Penguin holders own just 1 NFT

00:07:40 – Custom filters!

Alex gives a preview of a new feature that will allow users to narrow down specific search queries, such as:

- Looking for projects within a specific ETH range (in volume)

- Finding contracts by keyword (i.e. Apes)

- Search “Stephen” under the Bored Ape Yacht Club collection (Figure 3)

( alternatively you can view Nansen Wallet Profiler )

00:10:15 – How to generate alpha using Nansen

Remember, NFT markets are very illiquid. So follow where the liquidity is.

You can filter collections by volume. The higher the volume, the more liquid the collection. In the future, Nansen may provide smart alerts when one of your collections has an increase in volume!

00:14:48 - Ape DAO

Looking at Niftex’s Baddest Alpha Ape Bundle (aka Ape DAO)

Contract: 0xfa898efdb91e35bd311c45b9b955f742b6719aa2

https://pro.nansen.ai/nft-wallet-profiler?address=0xfa898efdb91e35bd311c45b9b955f742b6719aa2

00:16:14 - Fractionalized NFTs

NFTX, NFT20, and Niftex – all allow fractionalizing NFTs

In the case of $APED, the token tracks the floor price of the BAYC collection

00:18:46 – Q: “…I have no idea how to use Nansen!” and How do we use Nansen for discovery?

Alex describes the process as follows:

1) Discover y | Discover ( * new opportunities * )

2) Diligence | Perform due diligence

3) Defense | Set up smart alerts for real-time notifications

There are several ways to go about discovering a new project on Nansen.

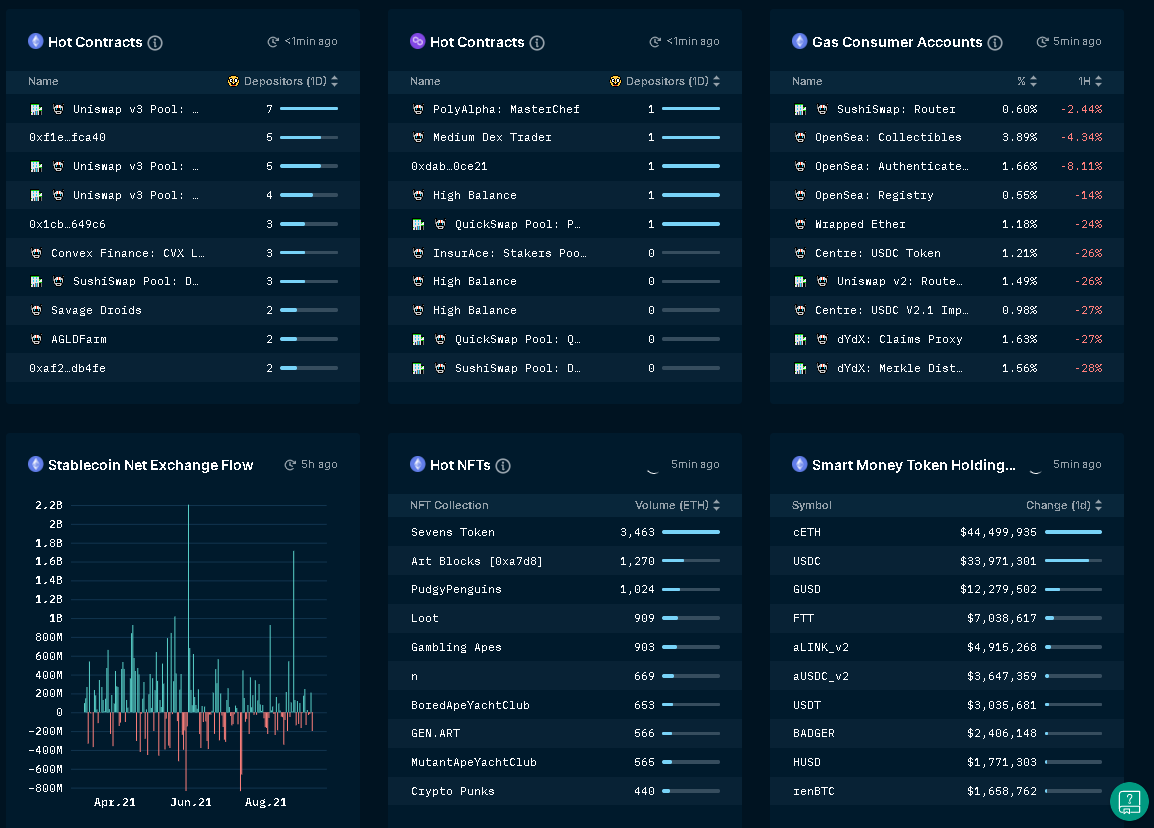

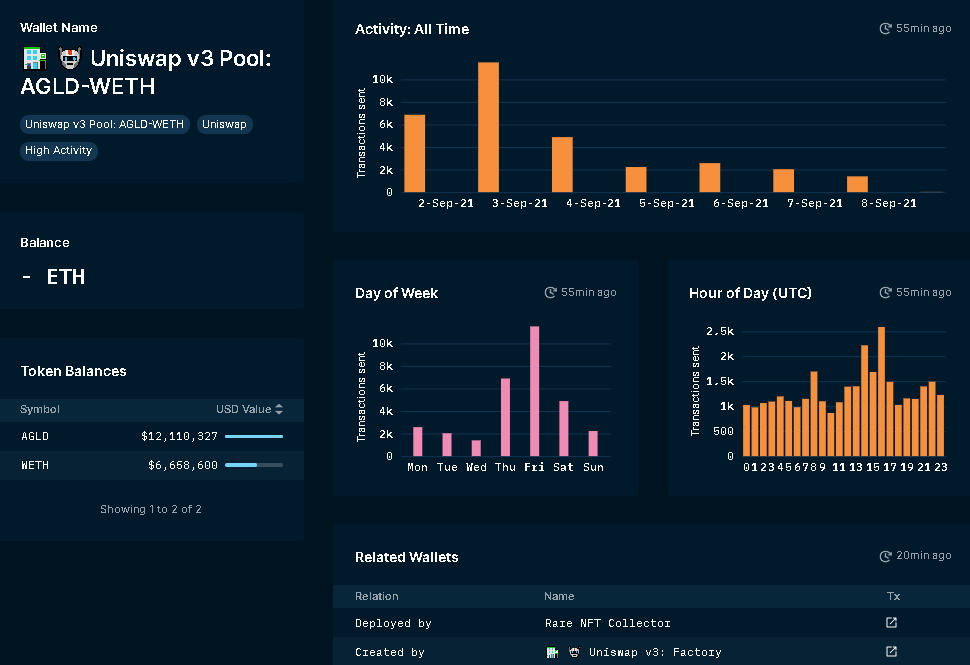

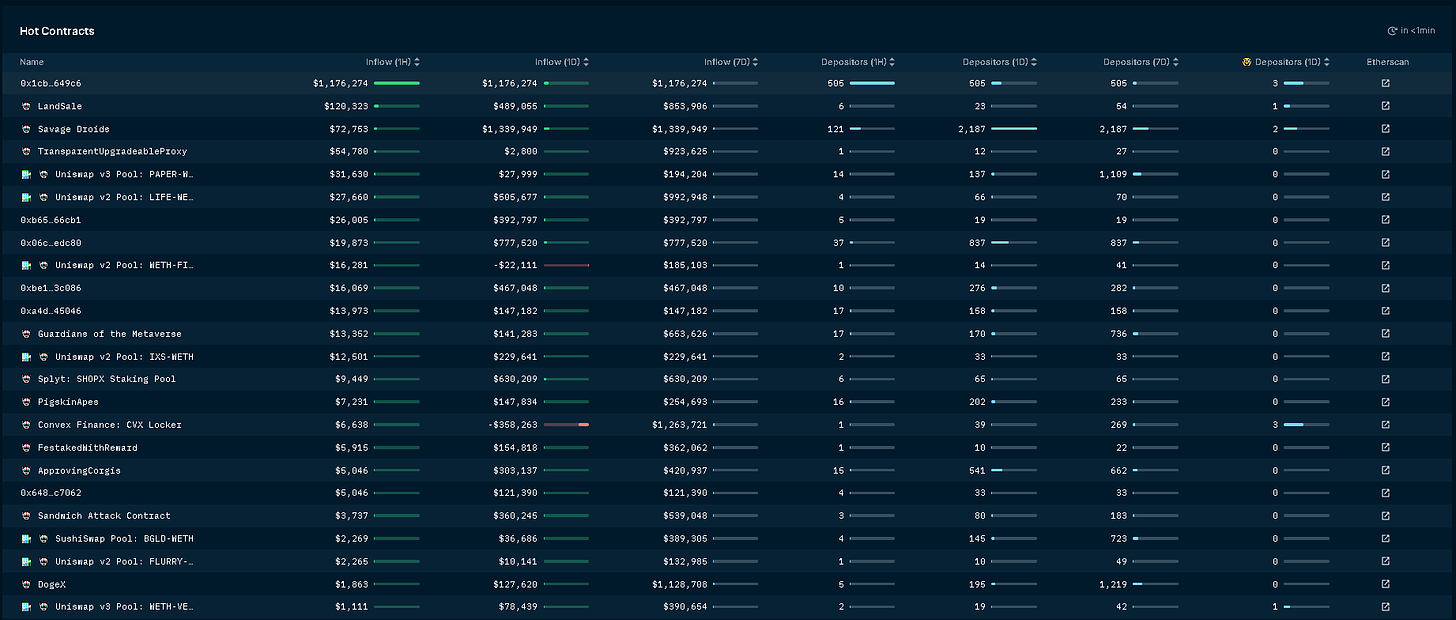

When looking at the home page, Hot Contracts is where NEW MONEY is flowing in.

The entries are sorted by the number of Smart Money depositing. Above we can see the AGLD-WETH Uniswap V3 pool had 7 Smart Money depositors in the past 24hr. To get even more information simply click on the entry to get to the Wallet Profiler.

With Wallet Profiler we can narrow down to see

- which counterparties sent ETH to the contract / EOA

- If a contract, who deployed it

- and more…

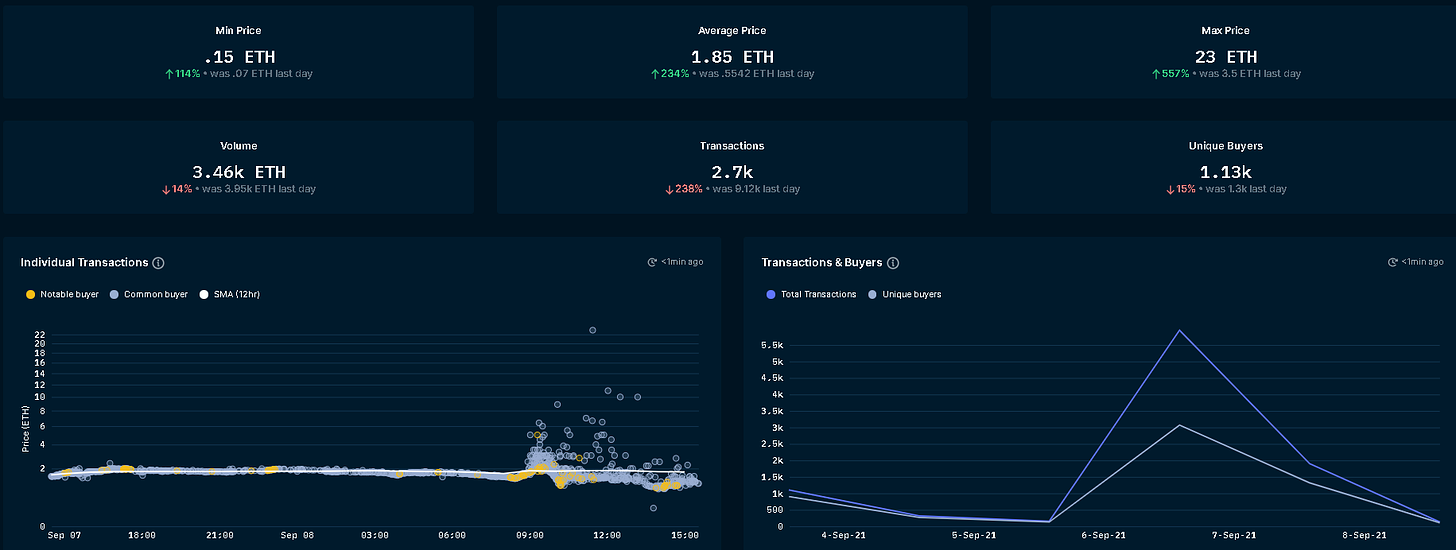

Also on the home page, Hot NFTs will provide an aggregate of data from NFT Paradise (see Figure 4)

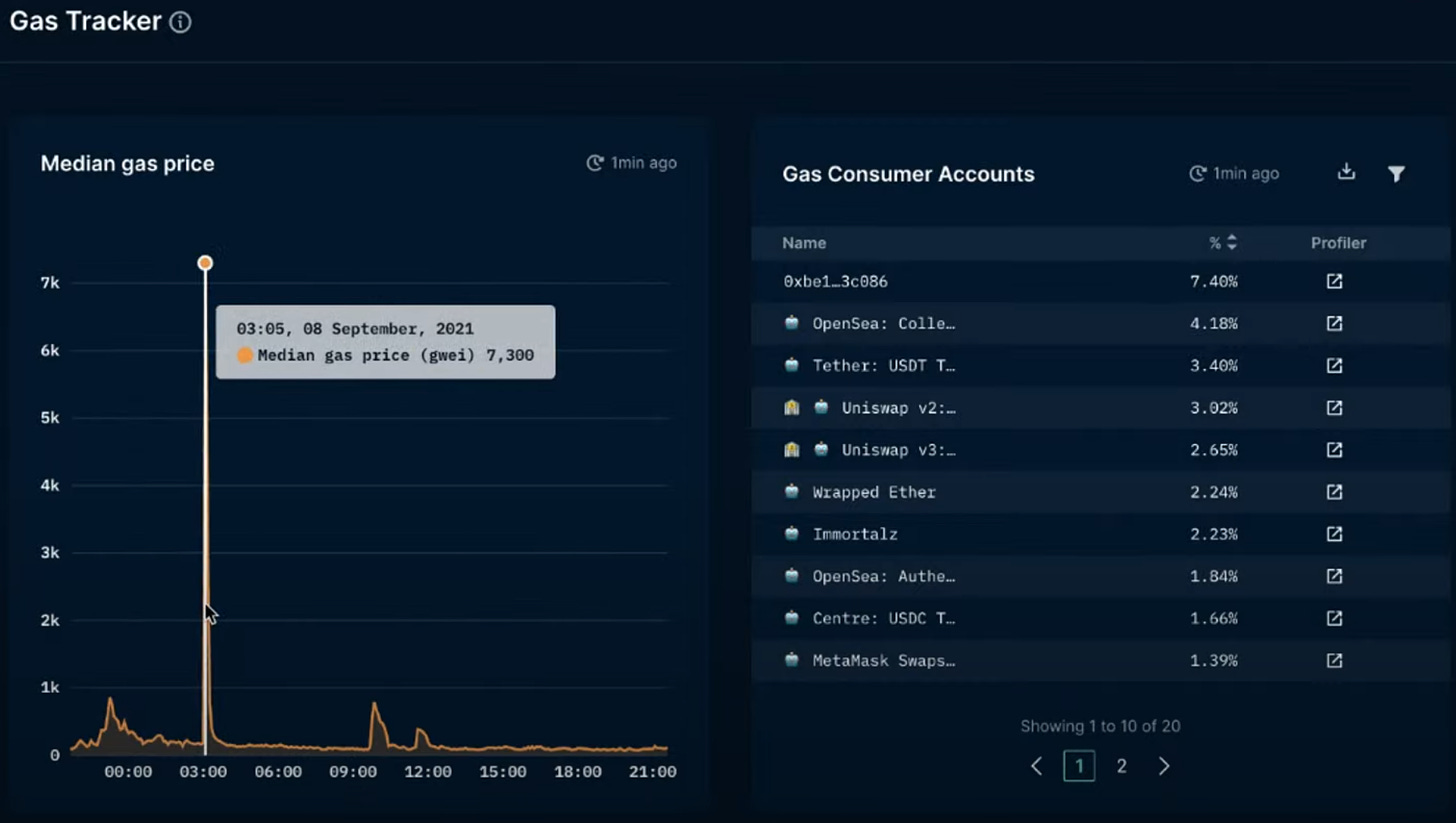

Lastly, Gas Consumers shows which smart contracts have consumed the most gas in the last hour.

TIP: Clicking on “!”, next to the name, takes you to the Gas Tracker dashboard ( https://pro.nansen.ai/gas-tracker )

00:24:38 – Hot Contracts is sorted by the number of Smart Money interacting with a contract, which is why occasionally NFT collections will show in Hot Contracts but may not be displayed under Hot NFTs.

00:30:55 –Nansen address book!

Add addresses and your own labels.

Mostly used for your own reference, right now.

Lots of ideas for how to provide more personalization for the end-user!

00:31:50 – Will Nansen take my labels? No

Nansen does not use user data for labeling.

May make the address book encrypted in the future just to give users more peace of mind.

00:32:40 – How can you provide feedback?

https://feedback.nansen.ai/

00:34:10 - Hot Contracts

Every Nansen subscription tier has a Hot Contract widget on their landing page, BUT only VIP has access to the full Hot Contract dashboard!

With the full H.C dashboard, you can see:

- Depositors (at different time intervals)

- Inflows

- Sort by contract age (i.e. 30 days)

For more information about Nansen VIP check out https://www.nansen.ai/plans

00:35:10 – How are Hot NFTs (NFT Paradise) and Hot Contracts different?NFT Paradise is sorted by trading volume (txs primarily from Opensea), whilst Hot Contracts looks at money flowing into a contract.

00:38:07 – Looking at Sevens | NFT

The Sevens NFT launch caused gas to hit a peak at over 7000 gwei just hours after the market went down, causing a cascade of liquidations which themselves caused a noticeable increase in gas (topping out near 1k)

00:41:10 – How NFT pricing works (using Sevens as an example)

Floor price tracks the lowest listed item (on Opensea)

Market looks more inflated, than it really is

Pricing is more closely related to real-estate rather than crypto

00:45:45 – Advice from Cooper

1) Buy the floor OR top 1%

2) Invest in what you like, not what others like

3) Not all collections are created equal

4) You’re trading against $ETH not $USD

00:51:20 – Security tips with Alex

How common is obfuscating wallets among top crypto trading institutions

Less common in NFT, because NFTs are so highly linked with identity. You can’t show off an NFT without revealing an address. This tactic is much more common in defi. Some funds embrace the transparency, but it is not easy. The reason it is not easy is because if you’re able to track down one wallet, it is easier to track down the related wallets (i.e. counterparties).

EXAMPLE: Five VC funds take part in a funding round, and four of them are already known to us. Through process of elimination, we can deduce the identity of the fifth, even if they choose to remain anonymous.

It is difficult to remain fully anonymous as an NFT trader. You have to determine whether you want to have a public profile or not. If you do, but don’t want to dox yourself, you have to create a new public persona. There are lots of pseudo-anonymous individuals in the defi / nft game that have identities specifically tied to their public address.

Another option is using Tornado Cash, however as Alex points out, it does not guarantee privacy as with the ‘Five VC funds’ example above. There is also the potential liability associated with owning an EOA funded with Tornado Cash as it is utilized quite heavily by scammers and hackers.

Will be back next week for more Notes!

List of projects sponsored by Nansen